Quick Intro?

The Reserve Bank of India (RBI) sets strict guidelines to ensure financial institutions uphold the confidentiality, integrity, and availability of customer and operational data. From KYC documentation to payment data, every piece of information must be protected against unauthorized access, leakage, and misuse.

Yet, many organizations still rely on policies and user awareness alone — leaving critical gaps in enforcement. miniOrange Data Loss Prevention (DLP) bridges this gap, offering automated, policy-driven protection that actively prevents data breaches and ensures continuous RBI compliance.

Let’s explore five key areas where miniOrange helps banks and financial organizations meet RBI data protection mandates.

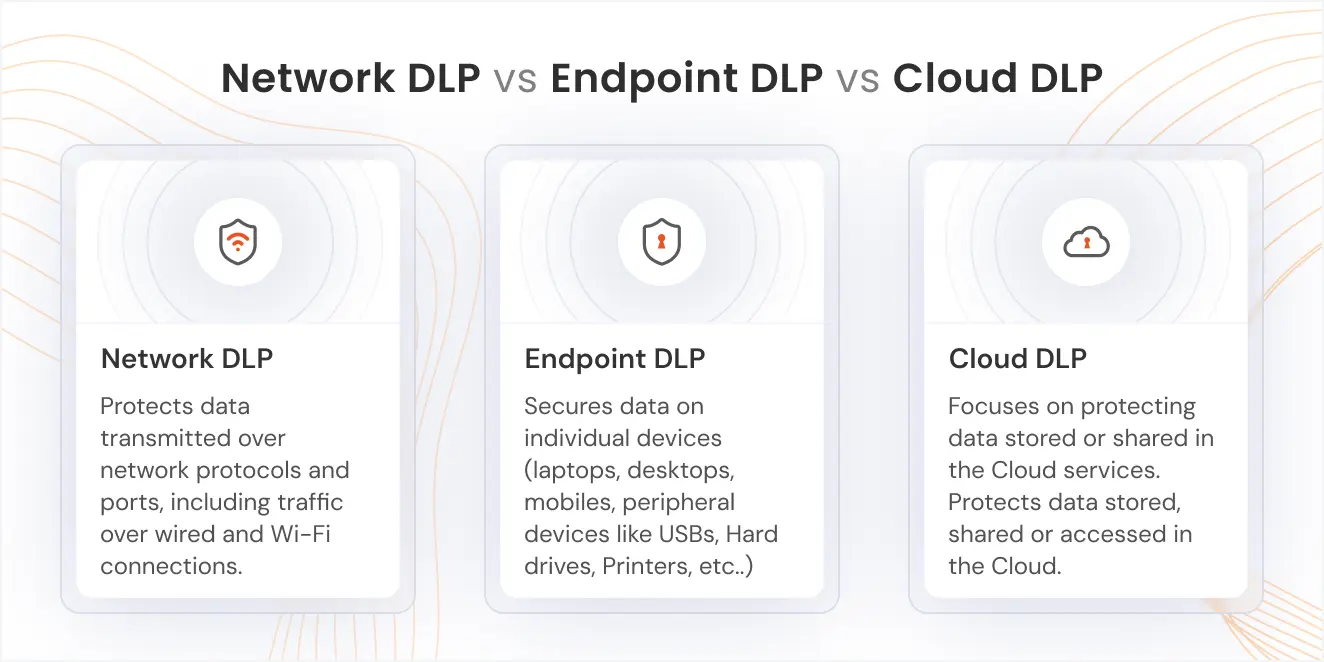

1. Discover and Control Data at the Endpoint

RBI Mandate: Secure endpoints and restrict unauthorized data transfers. Endpoints like laptops and desktops are the first line of defense and the most common source of data leaks.

How miniOrange helps:

- USB & Peripheral Control: Block unauthorized USB or storage devices. Allow only encrypted or whitelisted devices to transfer files, ensuring that customer KYC or financial data never leaves secure systems.

- Printer Control: Prevent printing of sensitive data to unauthorized devices ensuring confidential statements or audit reports don’t walk out of the office.

- Application Control: Block or restrict use of unauthorized software (e.g., third-party file sharing or chat tools) that could expose sensitive financial data.

Compliance Benefit: Enforces RBI’s endpoint protection and access control mandates.

2. Secure Data in Motion — Across Web & Cloud

RBI Mandate: Monitor and restrict data transfers to external networks and unauthorized cloud platforms. Data often leaves the organization through web uploads or cloud syncs. miniOrange provides deep inspection and policy enforcement for all outbound traffic.

How miniOrange helps:

- Website and Upload Policy :

- Block uploads of specific file types (e.g., .pdf, .xlsx, .csv) to non-whitelisted websites.

- Detect and block files containing Aadhaar, PAN, or credit card data before upload.

- Prevent access to personal email domains like Gmail or Yahoo.

- Cloud Application Login Control: Restrict logins to corporate-approved cloud applications (e.g., OneDrive, SharePoint) and block personal cloud storage accounts like Dropbox or Google Drive.

- Email DLP: Monitor, analyze, and control outbound emails to prevent accidental or intentional data leaks. Automatically block or quarantine emails containing sensitive information such as account numbers, Aadhaar, or PAN details sent outside approved domains.

Compliance Benefit: Ensures sensitive data never leaves through unauthorized online, cloud, or email channels.

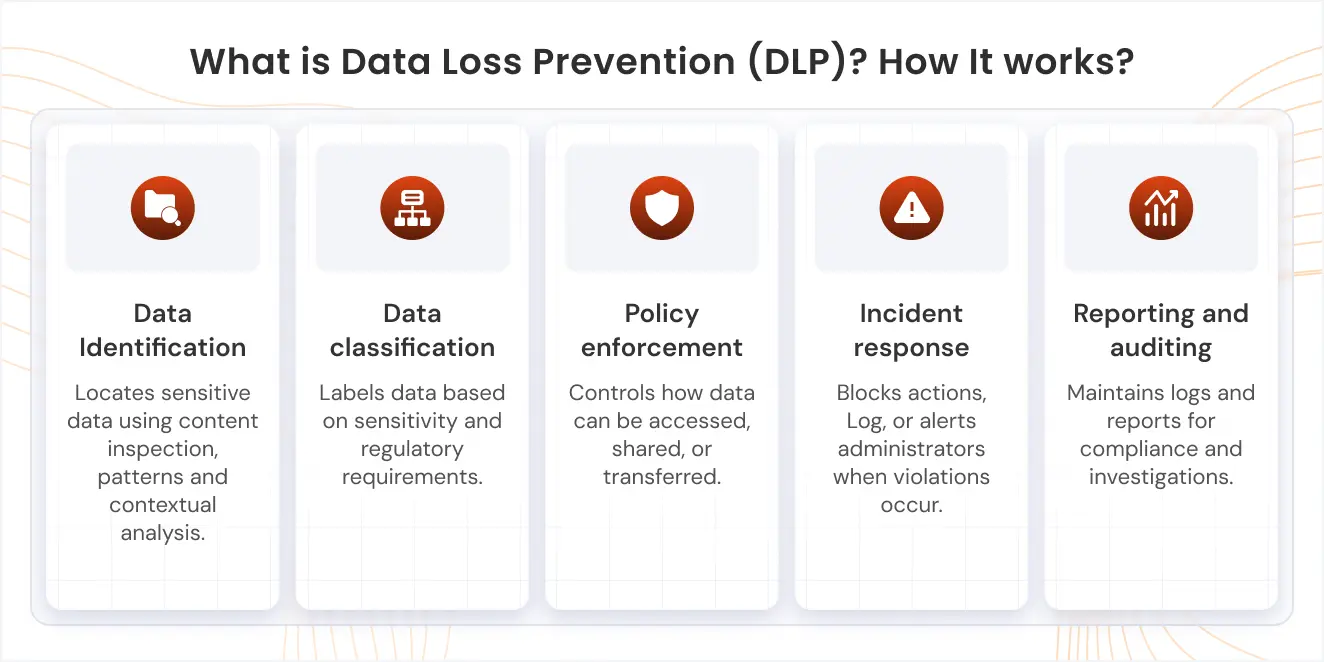

3. Data Classification and Content Awareness

RBI Mandate: Identify, label, and protect confidential customer and financial data.

How miniOrange helps: Using advanced data classification and content-aware inspection, miniOrange can automatically detect sensitive data — like account details, KYC documents, or financial projections — within files or messages.

- Create rules to detect patterns like Aadhaar, PAN, or account numbers.

- Automatically block, quarantine, or log any attempt to move or upload files containing such data.

- Enforce fine-grained control based on data type and destination.

Compliance Benefit: Enables proactive protection aligned with RBI’s confidentiality and data classification standards.

4. Enforcing Accountability and Audit Readiness

RBI Mandate: Maintain logs and evidence of data activity for audits and investigations.

How miniOrange helps:

- File Activity Logging: Tracks every file operation — creation, modification, deletion, and movement in critical folders like KYC directories or financial reports.

- Centralized Dashboard & Alerts: Offers real-time visibility into policy violations, high-risk incidents, and user activity.

- Automated Notifications: Instantly alert administrators when sensitive actions occur, ensuring swift remediation.

Compliance Benefit: Creates an auditable trail and simplifies RBI inspections or internal audits.

5. Advanced Monitoring & Access Control

RBI Mandate: Ensure controlled access, session security, and continuous monitoring of high-risk environments.

How miniOrange helps:

- Session & Password Policy Enforcement: Define concurrent session limits, inactivity timeouts, and strong password rules.

- Remote Lock & Wipe: Instantly secure lost or stolen devices.

- Screen & Camera Monitoring: Capture authorized screen or camera logs (with disclosure) for forensic investigation and insider threat monitoring.

Compliance Benefit: Prevents unauthorized access and provides real-time visibility into sensitive operations.

Compliance Scenarios: How DLP Protects Against GDPR, HIPAA & PCI-DSS Risks

- GDPR Compliance - Automatically scans outgoing Outlook emails to prevent the accidental sharing of EU citizens’ personal data without consent, helping organizations avoid costly fines and legal issues.

- HIPAA Compliance - Detects and blocks Protected Health Information (PHI) from leaving healthcare networks, ensuring patient confidentiality and regulatory adherence.

- PCI-DSS Compliance - Identifies and stops credit card details or payment information from being transmitted via email, protecting both customer trust and your brand’s reputation.

A Real-World Example

Consider a financial institution’s Accounts Department:

- They are allowed to access only approved financial portals and government websites.

- They can upload .xlsx or .pdf files only on specific internal web apps.

- These files must not contain sensitive customer information like PAN or Aadhaar data.

- Personal email logins (e.g., Gmail) are restricted.

miniOrange DLP enforces this complete workflow — ensuring data stays within RBI’s compliance perimeter at every step.

Conclusion: From Policy to Enforcement

RBI compliance isn’t just about drafting policies — it’s about enforcing them. miniOrange DLP transforms your compliance posture from reactive to resilient by providing real-time control over who accesses data, where it goes, and how it’s used.

Instead of relying on user discipline, miniOrange ensures RBI compliance through:

- Automated detection and prevention,

- Continuous monitoring and reporting,-

- Granular, enforceable data security policies.

Turn RBI compliance into a living, enforceable process not a paperwork exercise. Contact miniOrange today to schedule a personalized demo and learn how our DLP solution helps your institution achieve continuous RBI compliance.

Secure Your Emails, Protect Your Business

Talk to Our Experts Today Contact Us

Leave a Comment