DORA Compliance - A Must-Have for Financial Firms in 2025

The EU’s Digital Operational Resilience Act (DORA) became effective on January 17, 2025, reshaping how financial entities and ICT (Information and Communications Technology) providers manage cybersecurity and risk management. Whether you're a bank, insurance provider, crypto-asset service, or critical tech vendor, failure to comply with DORA compliance could lead to penalties, reputational damage, and operational downtime.

This blog will walk you through everything you need to know about DORA compliance, starting with the basics and why it’s crucial for your business. We’ll also highlight some key solutions to make your business compliant with this new rule in case you have missed the DORA compliance date in 2025.

What is DORA Compliance?

DORA (Digital Operational Resilience Act) is a rule by the EU that asks financial companies and tech providers to have strong systems in place to handle cyberattacks and tech disruptions without falling apart.

This means managing risks, keeping an eye on third-party services and having plans to deal with cyberattacks. Being DORA-compliant helps you keep your business secure and your customers’ trust intact. However, many organizations seem to have missed the deadline to become DORA compliant. According to a survey, around 43% of UK financial services organizations have missed the DORA compliance deadline since January 2025.

Why So Many Businesses Missed the DORA Compliance Deadline?

1. Thinking “We’ve Got This” — When They Didn’t

Many leaders assumed their existing GRC (Governance, Risk, and Compliance) setups were enough. But DORA compliance introduced a whole new level of depth. It demanded tightly woven ICT risk management across the entire organization.

2. Too Much to Do, Too Few Hands on Deck

Smaller and mid-sized firms often lacked the time, workforce, or budget to keep up with the DORA compliance deadline. With limited resources, rolling out a DORA compliance framework felt overwhelming, causing missed deadlines.

3. Blind Spots in Vendor Risk Management

Companies relying on third-party tech providers couldn’t assess those vendors’ DORA readiness. Without proper oversight, managing third-party risk became a major hurdle for financial firms.

4. Trapped in the Regulatory Web

For businesses operating across borders, meeting DORA compliance along with existing laws like GDPR turned into a complex task. This overlap led to confusion and slower progress.

Why is DORA Regulation necessary?

Let’s face it—the financial sector is a prime target for cyberattacks. In fact, in 2023, the average cost of a data breach reached an all-time high of USD 4.45 million. With digital systems more connected than ever, a single cyberattack can impact supply chains, disrupt critical services, and cause serious damage to customer trust.

That’s exactly why the EU rolled out the Digital Operational Resilience Act (DORA) which focuses on:

- Managing ICT-related risks with structured & clear processes

- Improving third-party risk oversight and incident response

- Enforcing regular penetration testing and disaster recovery plans

By shifting the focus to real operational resilience, DORA helps businesses prepare for modern cyber attacks and protect the entire financial ecosystem.

How to Get DORA Compliant: 3 Key Steps to Follow

Getting your organization to be DORA compliant doesn’t have to be overwhelming. In fact, a smart, structured approach can help you hit the ground running.

Step 1: Tackle the Most Critical Gaps First

Start by looking for high-risk areas like vendor management or incident reporting. Fixing these early can reduce major threats and prove you're actively working toward compliance with DORA.

Step 2: Use the Right Tools for the Job

Managing everything manually can be risky. Invest in security solutions that give real-time insights, automate reporting, and help you track DORA compliance across your systems effortlessly.

Step 3: Make Sure Your Vendors Are on Board

DORA compliance requires you to stay on top of third-party risks. Perform detailed assessments, schedule regular audits, and keep communication open with your vendors to ensure they meet the same standards you do.

The 5 Pillars of DORA Compliance

To meet DORA compliance, financial organizations and ICT providers should focus on five key pillars that help build stronger digital operations. Here's a quick and easy breakdown:

- Pillar 1 – Risk Management

It’s no longer enough to manage risks vaguely—DORA compliance requires leaders to fully integrate ICT risks into their overall risk strategy. This means approving clear policies and regularly reviewing them.

- Pillar 2 – Incident Response & Reporting

DORA compliance makes it mandatory to have a well-tested incident response plan. You’ll need to act fast, inform the right people (including regulators), and submit timely, accurate reports.

- Pillar 3 – Post-Incident Learning

DORA compliance requires organizations to review what went wrong, identify weak spots, and update their policies so the same issue doesn’t happen again.

- Pillar 4 – Operational Resilience & Third-Party Risks

DORA compliance requires you to define resilience goals, run regular stress tests, and keep a close watch on your third-party tech providers. That includes risk assessments, contracts, and having a solid exit strategy in case things go south.

- Pillar 5 – Information Sharing

It encourages secure information sharing across trusted networks to stay ahead of emerging threats—without compromising sensitive data.

Together, these five pillars make up the foundation for true digital resilience under DORA compliance. Up next, let’s look at who exactly needs to comply and what that means for your business.

How miniOrange Helps Businesses be DORA Compliant?

At miniOrange, we make DORA compliance easier by helping your organization stay secure, resilient, and ready for anything. Our security solution is built to protect every layer of your business environment—from user access to third-party integrations. Here’s how we do it:

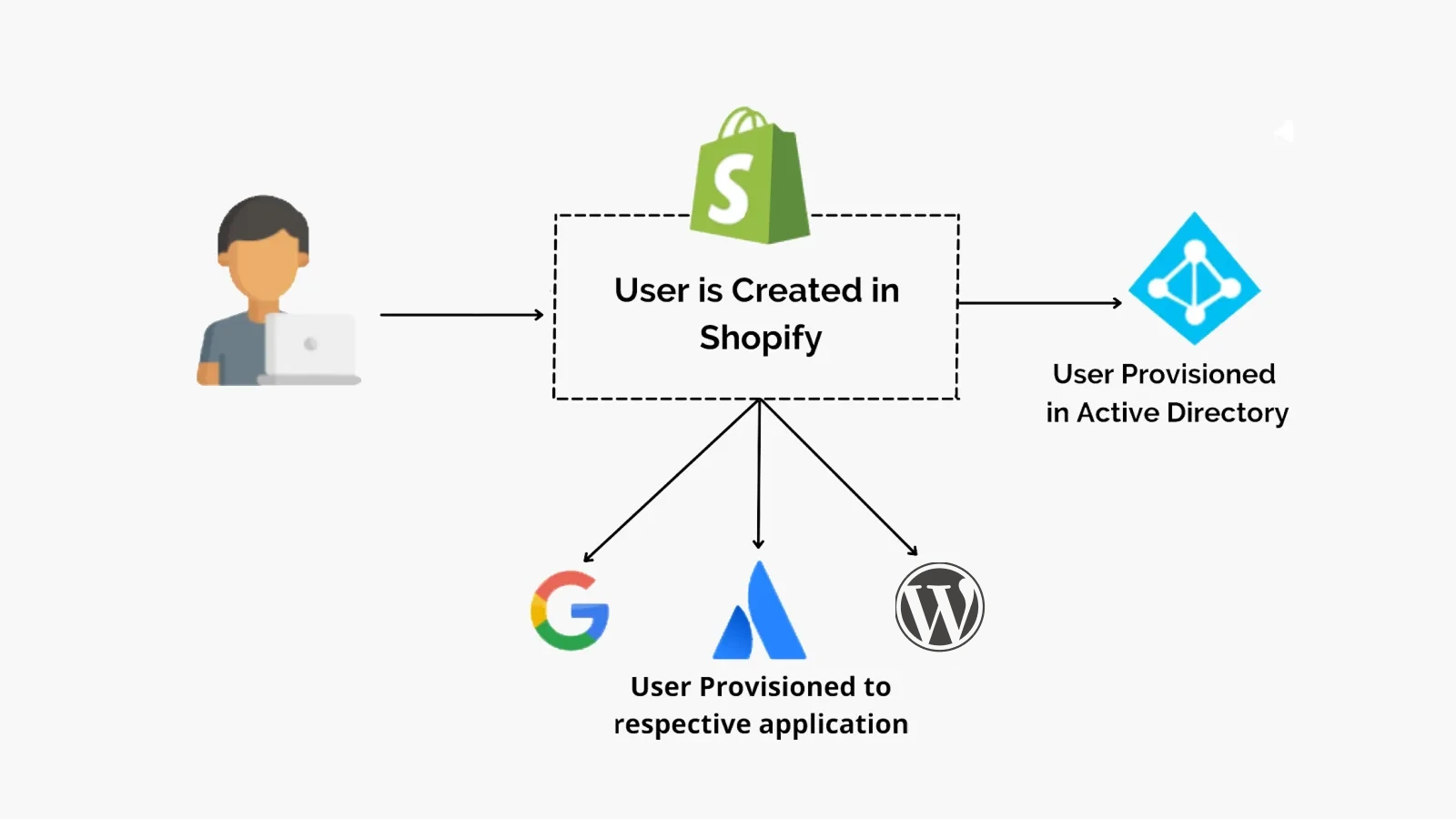

- Robust Access Controls We help you manage who gets access to what with secure IAM, CASB, MDM, DLP, and PAM solutions—integrating DORA compliance with industry standards like PCI DSS and AWS DORA compliance.

- Continuous Monitoring Our security solution offers real-time monitoring to let you detect suspicious activity fast and respond even faster, helping ensure compliance with DORA.

- Secure Third-Party Integrations We reduce third-party risks by offering secure connectors and integrations with popular platforms like Google Workspace, MS365, Zoho, and many more, ensuring compliance with DORA EU standards across the board.

- Incident Response Readiness miniOrange provides security to help you log, report, and act on incidents quickly—just what DORA compliance expects.

- Automation & Reporting Generate detailed reports to prove your organization is staying on track with DORA compliance.

Whether you’re just starting your DORA journey or need help filling in the gaps, miniOrange solution offers you the tools and expertise to guide you through every step.

Know more about the compliance we support.

In Conclusion

Delaying or ignoring the DORA compliance deadline can be a big mistake for businesses in the financial sector. However, by acting now, identifying the gaps, and creating a plan, you can meet the EU’s regulations and improve how your company handles risks and disruptions in the future.

At miniOrange, we make DORA compliance simple with solutions that give you the tools you need to stay secure and compliant. Whether it’s monitoring, access control, or managing third-party risks, we’ve got your back.

Ready to get started?

Have questions or need help? Email us at info@xecurify.com and we’ll guide you through the process.

Leave a Comment