Identity theft is the #1 cybersecurity attack in today’s time, and a huge threat to businesses. These attacks were continuously bombarded in 2024. Right from the Change Healthcare breach, where over 100 million customers were affected due to stolen Citrix credentials.

And what’s more? As per a report by Verizon, stolen credentials were the breach vector for over 80% of the web attacks in the 2023-24 timeline.

Identity theft falls under the umbrella of Account Takeover (ATO) attacks, where hackers take control over accounts via stolen usernames and passwords.

However, miniOrange offers passwordless authentication solutions for preventing identity theft and balancing security and user experience.

What is Account Takeover?

Account Takeover (ATO) is a type of cyberattack where the cybercriminals get hold of a user’s account credentials. Just by impersonating as real users, hackers can change user details, steal financial information, or send out phishing/malware threats.

As per a recent study by Javelin, American adults lost a total of $43 billion to identity fraud in 2023

Additionally, according to the Newswire, the number of exposed accounts is growing at an average of 28% annually, amongst which the Fintech vertical represents the highest annual growth rate of 32%.

Judging from the above numbers, organizations are likely to face huge financial losses, customer data leakage, and reputation damage if ATO attacks aren’t addressed with strong defense mechanisms.

How Do Account Takeovers Occur?

Hackers use a myriad of ways to take over accounts: from brute force to phishing, from trojans to man-in-the-middle attacks. Let’s take a look at the prominent ways in which ATO occurs.

1. Credential Stuffing and Brute Force Attacks

Credential stuffing involves the use of bots to attempt to log into accounts using a list of usernames and passwords. This is possible because many accounts have weak or reused passwords.

For brute force attacks, hackers use the trial-and-error method to crack open the accounts.

A recent example of credential stuffing is the Snowflake attack, where around 165 organizations using Snowflake (a cloud-based data warehousing and analytics platform) were targeted using stolen credentials harvested from infostealer infections dating as far back as 2020.

These affected accounts lacked MFA, enabling attackers to log in with a single compromised factor.

2. Phishing: A Gateway for ATO

Phishing is a dishonest tactic in which criminals pose as reliable organizations, typically through email, SMS, or phony websites, in order to fool victims into disclosing their login information.

Urgent messages like "Your account has been compromised" can be used by attackers, or ‘To reset your password, click here.’ This will take users to believable lookalike portals. Credentials are sent to criminals in silence after they are entered.

Phishing-resistant MFA solutions, such as biometric authentication, can be used to prevent such cybersecurity attacks.

3. Malware and Application Vulnerabilities

Attackers use malware, a malicious software installed via phishing links, infected attachments, or compromised apps, to steal login data.

Malware like keyloggers records every keystroke, transmitting usernames and passwords back to attackers. Some malware variants target browsers, capturing auto-filled credentials or authentication tokens.

Application vulnerabilities, such as flawed authentication mechanisms or insecure storage, can inadvertently expose sensitive user data.

Attackers exploit outdated software, unpatched systems, or poor coding practices to extract credentials from insecure databases or server logs.

4. Exploitation of Stolen Cookies, Hardcoded Passwords, and API Keys

Cookies save session information that, if stolen (by malware or browser exploits), enables attackers to pose as authentic users without requiring login credentials.

In a similar vein, developers occasionally leave client-side code or public repositories with hardcoded passwords or API keys.

By harvesting these secrets, attackers can obtain direct access to backend services or accounts. For example, fraudsters have been able to alter online transactions and steal private customer information thanks to leaked API keys.

5. Network Traffic Sniffing and Man-in-the-Middle (MitM) Attacks

Sniffing, also known as the MitM attack, is a technique that allows attackers to intercept unencrypted communication between users and servers.

Hackers obtain credentials in transit by taking advantage of weak internal networks or unprotected Wi-Fi (such as in public cafes and airports).

Industries at highest risk are cloud-based apps, financial institutions, healthcare providers, and companies with remote or distributed workforces are frequently targeted.

6. Mobile Banking Trojans

Mobile banking trojans are apps often disguised as legitimate software that silently collect credentials and authentication tokens from users’ devices.

Once installed, they can initiate unauthorized transactions, request additional permissions, and even bypass 2FA measures.

With mobile banking usage skyrocketing, these trojans are a rising threat for both individuals and businesses.

The Impact of Account Takeover Attacks

- Data Theft: Stolen information, including credit card numbers and personal details, may be sold on dark web marketplaces or utilized in additional fraudulent activities.

- Malware Delivery: The infection chain is extended when compromised accounts send malware to contacts through messaging or email.

- Follow-on and Lateral Attacks: By acting as a springboard, an initial ATO can give attackers access to additional sensitive systems, increase their level of privilege, and carry out more extensive breaches.

- Financial Loss: Unauthorized transactions, chargebacks, legal costs, and damage to a company's reputation can all result in direct financial loss for victims, whether they be customers or businesses.

How to Defend Against Account Takeover Attacks?

1. Strong Password Policies

Enforce complex, unique passwords across all accounts. Mandate periodic password changes and recommend password managers to reduce the re-use of passwords for systems.

2. Phishing Protection

Deploy email filtering to block malicious messages. Implement ongoing employee training and awareness campaigns to help users spot phishing attempts.

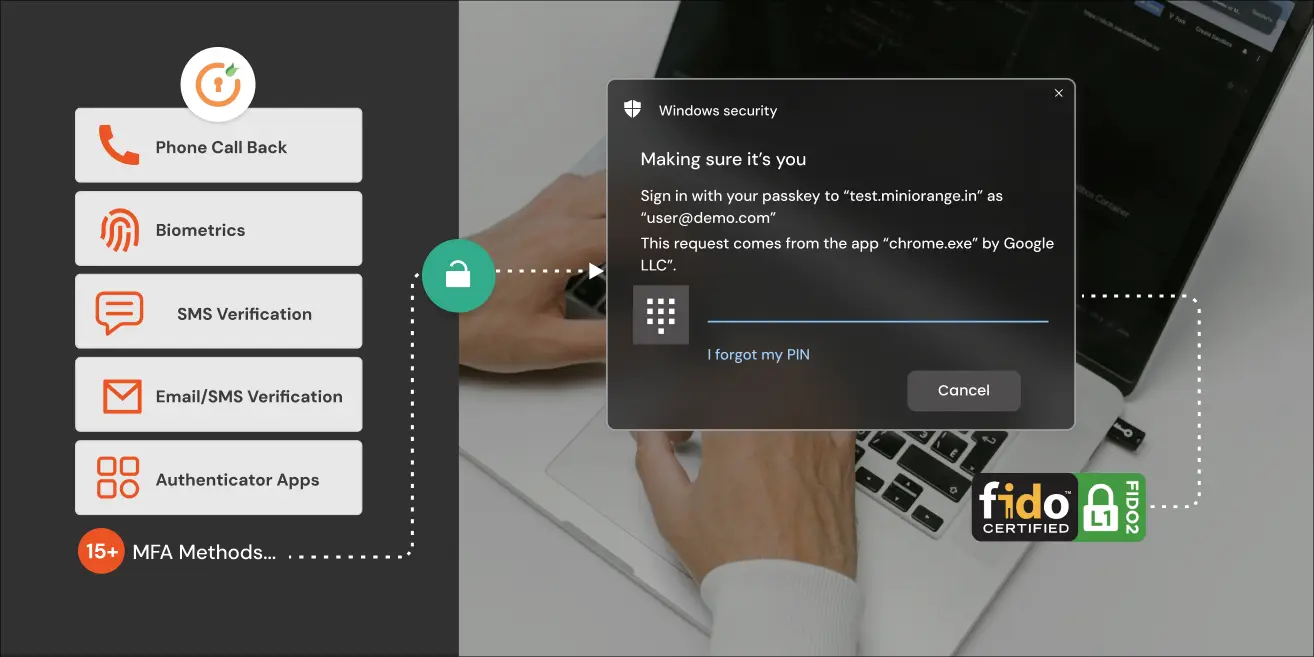

3. Multi-Factor Authentication (MFA)

Integrate MFA for sensitive accounts. Even if passwords are compromised, a second factor provides strong defenses against threats.

4. Regular Application Security Testing

Conduct vulnerability scans, code reviews, and security audits. Address flaws before attackers can exploit them.

5. Login and API Security

Use modern authentication frameworks (e.g., OAuth, SSO) for user and API access. Rotate and securely store API keys; never leave them hardcoded or exposed.

6. AI-Based Detection and Account Tracking Systems

Utilize AI/ML systems to spot unusual access patterns, such as logins from new devices, geographies, or rapid credential stuffing attempts. Automated alerts and account monitoring help contain threats early.

7. Web Application Firewalls (WAFs)

Deploy WAFs to flag and block suspicious activity (e.g., bot attacks), safeguarding web apps from many ATO methods.

What are ATO Attack Mitigation Strategies?

1. Behavioral Analytics

Behavioral analytics is a proactive approach to detecting account takeover (ATO) attacks by monitoring and analyzing user behavior patterns.

Rather than relying solely on static security measures like passwords, behavioral analytics evaluates how users interact with systems, such as their typical login times, devices, IP addresses, and even how quickly they type or navigate a site.

When the system detects an anomaly, for example, a login from an unusual location, a sudden surge in data downloads, or modifications to account settings, it immediately flags the activity for investigation.

This rapid identification of abnormal behaviors reduces the time between an attack’s onset and the security team’s response, making it much harder for malicious actors to inflict widespread damage.

2. Zero Trust Security Model

The Zero Trust security model operates under a guiding principle: never trust, always verify. In this framework, no user, device, or system, whether inside or outside the organization’s network, is trusted.

Every access request is continuously authenticated, authorized, and validated for security compliance. Even after gaining initial access, users must repeatedly prove their identity and intent before moving laterally within a network.

This approach significantly limits an attacker’s ability to exploit a compromised account, as access rights are strictly enforced and constantly reevaluated.

What Types of Organizations are Targeted by the ATO Attacks?

Financial Institutions

If criminals gain access to a customer’s account, whether it’s a bank account, credit card portal, or payment app, they can steal money, initiate fraudulent transactions, or even open up new credit lines in the victim’s name.

E-Commerce Websites

E-commerce platforms are frequent ATO targets because customer accounts usually contain saved payment information, order histories, personal addresses, and sometimes loyalty rewards or store credit. Attackers take over user accounts to make unauthorized purchases, redirect shipments, or redeem stored value like gift cards.

How Can You Secure Your Business Data Against Corporate Account Takeovers?

Here’s how you can secure your business data:

1. ATO Detection and Response

Deploy real-time detection tools to flag abnormal activity. Use automated workflows to lock compromised accounts and notify security teams.

2. Employee Education

Employee education is vital in defending against account takeover attacks. Regular training helps employees recognize and avoid phishing emails, suspicious links, and social engineering tactics used by attackers to steal login credentials.

3. Protecting the Online Environment

Securing your online environment is crucial to preventing account takeover attacks. This involves deploying strong firewalls that act as barriers, blocking unauthorized access attempts at the network perimeter.

4. Continuous Vigilance

Organizations must stay informed on the latest attack techniques and emerging vulnerabilities by subscribing to threat intelligence feeds and participating in security communities.

Routine updates to software, security policies, and infrastructure patch known weaknesses and close gaps before attackers exploit them.

Conclusion

Account takeover attacks are evolving via phishing, malware, and clever exploitation of system weaknesses. So, layered defenses are essential, such as, combination of strong authentication, continuous monitoring, proactive user education, and AI-driven analytics to stay ahead.

Take Action: Review your systems, implement the recommendations above, educate your teams, and upgrade your security posture to defend against the ever-changing threat of account takeover.

Secure IT right with the miniOrange authentication solutions today!

FAQs

What are the most common signs of an account takeover attack?

Common signs of account takeover attacks are authentication anomalies, unusual login patterns, suspicious account activities, and account lockouts.

Can AI alone prevent account takeover?

No, AI is a powerful tool for detection and prevention, but it cannot provide complete protection by itself. A strong defense requires a combination of AI, traditional security tools, context-aware policies, user education, and layered authentication measures.

How can I protect my business against corporate account takeovers?

Here’s what you can do

- Educate employees on cybersecurity attacks

- Integrate MFA solutions

- Update software regularly

Why is Multi-Factor Authentication (MFA) important for ATO prevention?

MFA adds additional barriers, making it much harder for attackers, who might have stolen credentials, to successfully access an account.

What are the legal implications of a successful account takeover attack?

Legal implications include legal actions, regulatory penalties, reporting obligations, financial liability, and more.

What’s the difference between account takeover vs. identity theft?

The goal of the ATO is to steal and abuse user accounts, whereas identity thefts involve impersonation, opening new accounts, and aims for fraud.

What’s the difference between credential stuffing vs. account takeover?

- Credential Stuffing: An automated tactic where stolen username/password pairs (often from a past breach) are used in bulk to try to access accounts on many platforms.

- Account Takeover: Once the attacker gains access, they control the account and can commit fraud.

Leave a Comment