Maintaining user experience and legal compliance are two extremely tedious tasks companies face globally. Earlier, security was limited to the extent of the on-premise environment. However, with digital growth, users have increased interactions with devices, networks, and data. This gave rise to cybersecurity attacks in multiple ways, including data theft, misuse of personal data, and more.

In order to address the rising issue, the European Union (EU) made regulatory compliance an important aspect of security experts’ planning and development processes. Active security measures like multi-factor authentication are to be implemented as a part of this compliance. miniOrange, as your security software solution partner, can simplify multi-factor authentication and compliance revolving around the evolving security for your specific business type.

This blog aims to simplify laws and regulations, emphasizing the cruciality and compulsion of MFA compliance in Europe.

Understanding the MFA service

Multi-factor authentication is a layered way of verifying the identity of a user by asking for two distinct forms of proof or authentication. This can typically be something they know (like a password), something they have (like a smartphone or token), and something they are (like a fingerprint or facial recognition).

MFA plays a critical role in enabling secure remote access, particularly for distributed teams and hybrid workforces. This is essential for protecting corporate assets against phishing, credential theft, and session hijacking.

Modern implementations increasingly rely on adaptive MFA, which goes beyond static rules by evaluating contextual factors such as user location, device health, login behavior, and network risk. Based on this analysis, the system dynamically adjusts authentication requirements, prompting additional verification for high-risk scenarios while streamlining access for trusted users.

Learn the Key Differences Between 2FA and MFA

Factors Contributing to the Growing Need for MFA

Multi-factor authentication has slowly entered the daily lives of users. From logging in to your bank account to making alterations in your E-commerce account details, MFA secures you. So, let’s understand the aspects presenting this demand.

Regulatory Compliance

Data protection laws and measures have gained serious traction globally since the COVID-19 pandemic. California Consumer Privacy Act (CCPA), General Data Protection Regulation (GDPR), and more are encouraging enterprises to take proactive measures to safeguard personal and sensitive data. MFA ensures compliance and reduces the risk of identity theft, along with penalties due to failure to comply.

Account Takeover Prevention

In 2024, the Account Takeover (ATO) attacks were growing significantly, and in many cases, there was a boost of 250%. The number is large enough for enterprises to think over and take necessary steps to avoid ATOs.

Moreover, this type of attack works differently from a phishing attack. The attackers program a computer to crack the user’s password from common letters, numbers, symbols, and characters to find the right sequence. A simple yet reliable solution is to employ MFA to prevent 99% of account compromise attacks in your organization.

Remote Work Environments

It is expected that the remote workforce will increase by 87% in Europe, making remote logins and work-from-home a common practice. However, this is also raising questions on how enterprises will boost the security of the workforce and protect confidential data. As businesses need a reliable solution that adheres to security needs, an extensive MFA solution is a must.

Adoption of BYOD

Bring Your Own Device has become a trend and continues to grow across enterprises and businesses, permitting employees to use their personal devices for work purposes. In access management, the miniOrange SSO Product simplifies the process but poses a security risk if not combined with additional protective methods. miniOrange MFA Software minimizes the concerns by adding an extra layer of authentication, reducing the possibility of unauthorized access in case of compromised security.

Prevent unauthorized access with secure push notifications

Compliance Requirements Surrounding MFA in Europe

The following compliances aim to boost cybersecurity resilience across organizations in Europe. Moreover, this compliance with MFA will secure online accounts and systems by necessitating multiple forms of verification from the users.

General Data Protection Regulation (GDPR)

GDPR compliance is primarily focused on enterprises operating in the European Union (EU) or serving EU citizens. Under the law, organizations must secure personal data with appropriate technical measures. According to the guidelines of the European Union Agency for Cybersecurity (ENISA), systems accessing personal data should be authenticated with particular security measures, including MFA.

EU Payment Services Directive 2 (PSD2)

PSD2 was adopted in 2015, and it was fully implemented by the end of 2020. The EU has mandated that consumer electronic payments above €50 require MFA. A key factor of this regulation is Strong Customer Authentication (SCA). It requires that the user/purchaser’s identity be verified by providing two out of three common factors among the authentication solution. These factors are:

- Knowledge factor (PIN or password)

- Possession factor (token or device)

- Inherent factor (fingerprint or facial recognition)

Network and Information Systems Directive 2 (NIS 2)

As per Article 21 of NIS 2, organizations working in critical sectors need to enable multi-factor authentication as a pivotal security measure.

Section 2 (j) specifies – the use of multi-factor authentication or continuous authentication solutions, secured voice, video, and text communications, and secured emergency communication systems within the entity, where appropriate.

In simple words, an MFA in the EU is required, where the lack of authentication can lead to security breaches.

Electronic Identification and Trust Services (eIDAS)

eIDAS is an EU regulation that governs electronic identification, signatures, and certifications. Electronic identification schemes at the level of substantial assurance require two-factor authentication. In 2024, the EU introduced eIDAS 2.0 to boost security and user trust in digital communication. European citizens will receive a wallet from recognized organizations through a mobile application, which will include their identity documents and attributes. Users can authenticate themselves with MFA to confirm their identity.

Don’t wait for another security breach. Learn how multi-factor authentication strengthens your security posture.

EU Cybersecurity Act

The Cybersecurity Act provides the foundation for future regulations and standards that might include MFA requirements. It established a framework for cybersecurity certification of products, processes, and services. While the Cybersecurity Act itself doesn't directly mandate MFA, it supports the development of cybersecurity schemes that may include MFA requirements. These schemes can be developed for specific sectors or product types.

Digital Operational Resilience Act (DORA)

Financial institutions in the EU must implement strong authentication, which in practice means MFA, to comply with DORA. The regulation applies to a wide spectrum of financial entities, including financial market infrastructure such as trading venues, insurance companies, investment firms, and payment service providers. As per DORA, incorporating MFA certainly aligns with the regulation’s aim to improve cybersecurity.

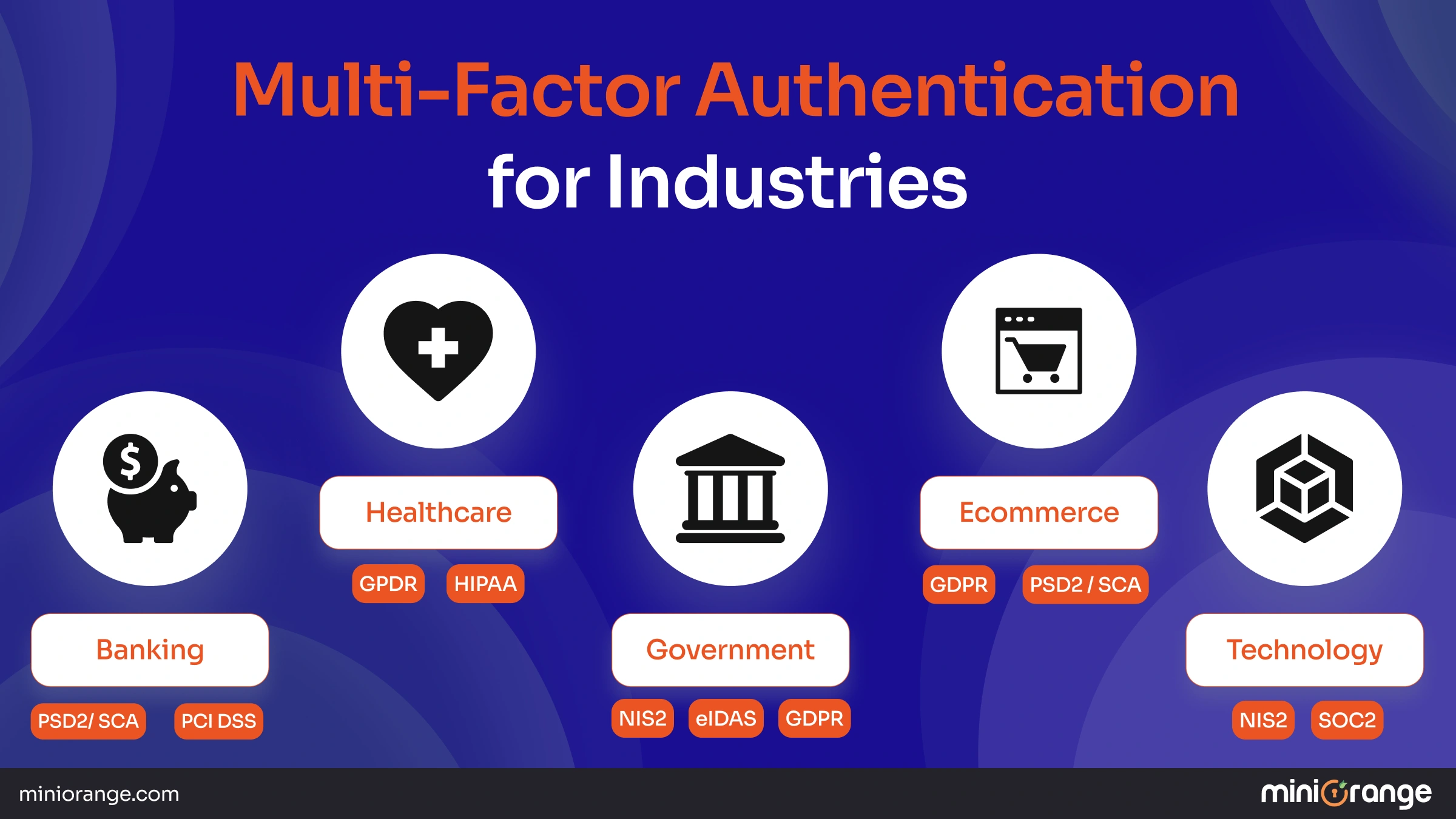

Industries That Have an MFA Mandate

Now that you know all the regulations that will require compliance with MFA regulations in Europe, certain industries need it more than others. Let’s give it a look:

Banking and Finance

A multi-layered approach is the industry standard in banking. MFA for Banking and Finance is required for all high-risk banking activity, including logins to bank accounts or making large financial transactions. The Payment Services Directive 2 (PSD 2) requires banks to implement Strong Customer Authentication (SCA), which involves MFA.

The financial services sector was one of the early adopters of MFA. Moreover, the Payment Card Industry Data Security Standard (PCI DSS) has made it compulsory for financial institutions to have MFA to prevent unauthorized access leading to data breaches or monetary losses.

Healthcare

Hospitals and clinics hold some of the most sensitive information. This can include patient history, insurance details, and more, calling for adequate digital safety measures. Therefore, GDPR in Europe emphasizes strong protection of personal data and records. This meant healthcare professionals need to put more effort than mere passwords to keep the data safe.

MFA implementation was also necessary due to the rise in telemedicine and online portals, where patient information and related data are put on these portals. Additionally, this will not only comply with the GDPR compliance but will also create a sense of trust in patients that their healthcare data is safe.

Defense and Government Sector

Government and Defense departments are armed with highly sensitive data, from national security information to personal details of citizens. Therefore, multiple regulations, such as GDPR, NIS 2, and eIDAS, were formed to enhance data protection practices. MFA played a pivotal role here, as many governments adopted the Zero Trust Security Model. Enabling MFA is not just a GDPR compliance move; it is also a strategic move to maintain public safety and safeguard essential data.

E-commerce and Retail

Online shopping is part and parcel of our everyday lives, but it is not an opportunity for fraud and data breaches. This falls under the responsibility of retailers to secure and maintain payment card details.

MFA is a widely adopted solution in e-commerce and retail to provide a secure platform for users without worrying too much about security breaches. There are additional verifications when logging into the account, like a fingerprint or OTP, to maintain account data. For making payments, PSD2 compliance is to be done.

Technology and Telecommunications

Tech companies that primarily handle user data and intellectual property rights have to comply with GDPR compliance with MFA. Although GDPR, in this case, does not largely imply MFA in all cases, but requires “appropriate technical and organizational measures" to protect personal data. Telecom companies are considered an integral part of critical infrastructure, making them subject to the NIS2 directive. This directive puts compulsion on MFA implementation in critical infrastructures, including telecommunications industries.

Things to Consider When MFA is a Mandate

Since MFA is no longer an option for enterprises in Europe, you will also need a head start on beginning the MFA implementation process.

Step 1: Understand the Compliance Requirement

Start by outlining the requirements and specifying which accounts or systems will have an MFA. Will it be work emails, company applications, specific software, or the entire network? Once you have identified exactly where you want to set your MFA or where compliance is required, you can proceed with the next steps.

Step 2: Choose your MFA Method

Once you understand the compliance requirement, choose the most prevalent MFA method for your business. There are many authenticator apps that provide comprehensive MFA solutions, like miniOrange Security Software, based on your needs and security challenges. You can also choose the authentication modes from facial recognition, fingerprint, iris recognition, and more.

Step 3: Set The Process Up

Setting up the process is critical; therefore, understand the instructions in detail. One of the most vital steps in setting up MFA is backing up your recovery codes. These codes are your lifeline if you lose your phone, switch devices, or otherwise can't access your primary MFA method. Store these recovery codes in a secure location, preferably a password manager or a physical safe.

Step 4: Stay Updated

If MFA is new to you, there will be a minor learning curve around it. Moreover, technologies and security policies evolve, creating space for compliance. Stay informed about any updates or changes to the 2FA requirements from your organization or service providers. Being proactive and adaptable will ensure you're always protected.

miniOrange’s MFA Solutions to Enhance Security

Regulatory compliance is vital for organizations based in Europe, and Failure to comply with regulations can invite unwanted fines. With miniOrange’s Multi-Factor Authentication Solution, all your GDPR MFA Requirements and other compliances will be fulfilled with an added layer of security. Our MFA method supports:

- SMS & Phone Callback

- Authenticator Apps

- miniOrange Authenticator

- Email Verification

- Hardware Token

- Security Questions

With us, you can shield your network devices like VPNs, Firewalls, Routers, and more. Also, safeguard your Active Directory, Windows, Linux, & Mac login access.

Conclusion

Regulatory compliance is a rocky road in the EU; therefore, CSOs and IT managers have to stay updated with the latest laws, policies, and directives. These regulations highly emphasized user data protection and robust security measures to be implemented in organizations. Contravention of these regulations can lead to hefty fines and even imprisonment, something organizations would want to avoid. Strong authentication is ideal as it avoids cybersecurity threats, including phishing attacks, account takeovers, man-in-the-middle attacks, and more.

FAQs

What is the MFA in the EU?

In the European Union, MFA (Multi-Factor Authentication) refers to a security requirement under regulations like PSD2 and NIS2, which mandate strong customer authentication for electronic payments and access to sensitive systems. MFA ensures that users verify their identity using at least two independent factors, such as a password, device, or biometric, making unauthorized access significantly harder.

What is GDPR compliance in Europe?

GDPR compliance means adhering to the EU’s General Data Protection Regulation, which governs how organizations collect, process, and protect personal data of individuals in the EU. It requires transparency, lawful data processing, user consent, data minimization, and robust security measures, with penalties for violations reaching up to €20 million or 4% of global revenue.

Is MFA required for GDPR?

While GDPR does not explicitly mandate MFA, it requires organizations to implement “appropriate technical and organizational measures” to protect personal data. MFA is widely recognized as one of those measures, especially for systems handling sensitive information, and is often recommended by EU cybersecurity bodies like ENISA to reduce the risk of breaches.

Who is required to be GDPR compliant?

Any organization, regardless of location, that processes personal data of individuals in the EU must comply with GDPR. This includes EU-based companies and non-EU businesses offering goods or services to EU residents or monitoring their behavior online. Compliance applies to both data controllers and processors, covering a wide range of industries and operations.

Leave a Comment