Need Help? We are right here!

Search Results:

×

Financial institutions must comply with numerous regulatory frameworks, like SWIFT CSP, PCI DSS, SOX, GDPR, NCUA for credit unions, 23 NYCRR 500 for New York operations, and FISMA/NIST for federal government work. Regional standards across UAE, Saudi Arabia, and other GCC territories add additional complexity.

Privileged Identity Management streamlines compliance through automated audit trails, real-time session recordings, and detailed regulatory reporting that satisfy examination requirements, enabling financial institutions to demonstrate adherence across all applicable frameworks.

Unprotected privileged accounts provide direct access to core banking infrastructure, enabling attackers to encrypt critical financial data and demand millions in ransom while disrupting customer services and transaction processing.

Without privileged access controls, malicious insiders can abuse elevated permissions to steal customer data, manipulate financial records, or even transfer funds, proving 60% of financial breaches involve insider access.

Lack of role separation enables single individuals to initiate, approve, and execute high-value transactions, creating opportunities for fraud and violating regulatory compliance requirements across trading and banking operations.

Unmanaged privileged accounts provide unrestricted access to customer PII, payment records, and proprietary trading algorithms, leading to data breaches that can result in identity theft and competitive intelligence loss.

Non-compliance with banking or financial regulations due to inadequate privileged access controls can result in millions in penalties, regulatory sanctions, and potential loss of operating licenses.

Automatically identifies and catalogues privileged accounts across core banking systems with Automatic Discovery of Privileged Accounts functionality to eliminate security blind spots.

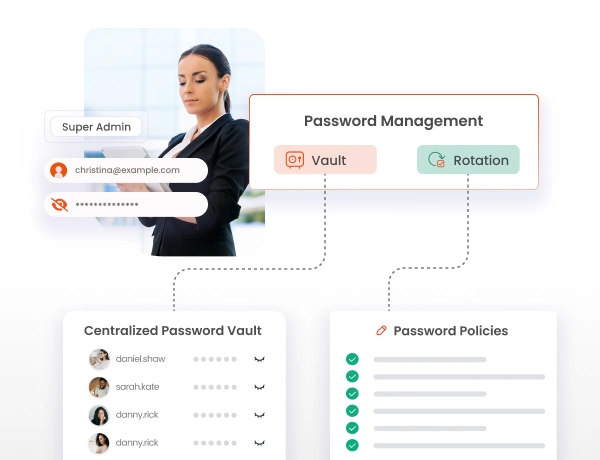

Secures sensitive financial credentials with Password Vault & Rotation capabilities, providing encrypted vaulting and automated password rotation for regulatory compliance and breach prevention.

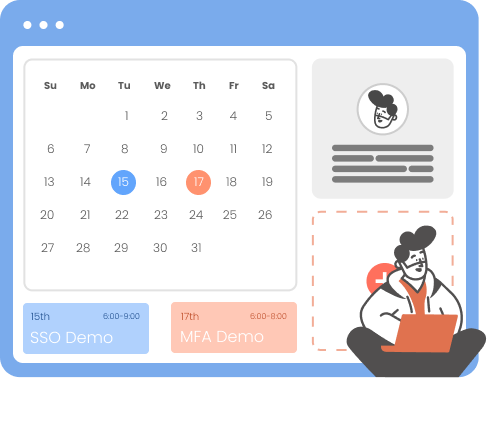

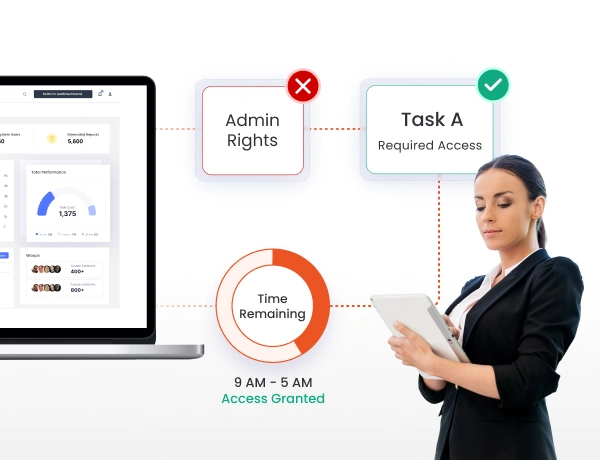

Provides temporary elevated privileges through Just-In-Time Access for urgent financial transactions, system maintenance, and emergency operations while maintaining comprehensive audit trails.

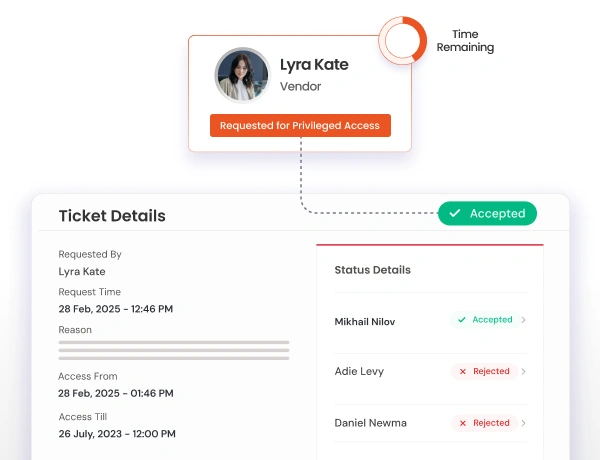

Protects work-from-home staff and third-party vendor connections using Vendor Privileged Access Management with secure gateways, multi-factor authentication, and controlled access.

Enforces role separation between trading, compliance, and operations teams through Segregation of Duties controls to prevent conflicts of interest and ensure regulatory compliance.

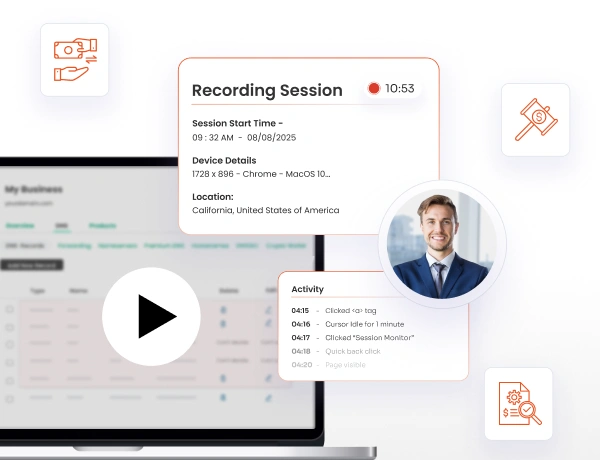

Records all privileged banking activities with Session Recording & Monitoring capabilities, providing audit-ready documentation for regulatory examinations and compliance reporting requirements.

Secures financial workstations and trading terminals using Endpoint Privilege Management, preventing unauthorized access to sensitive banking applications and customer financial data.

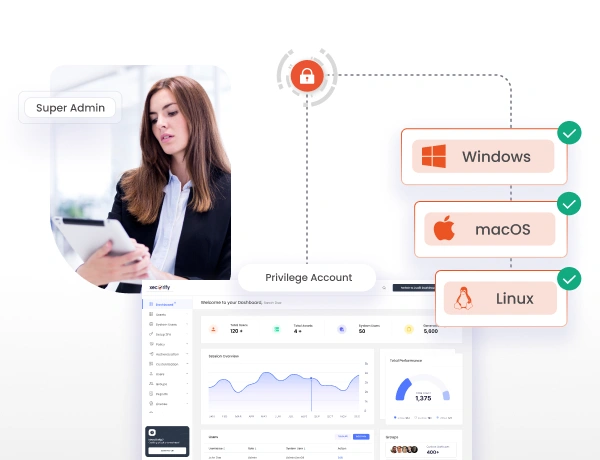

Full data sovereignty and regulatory compliance with miniOrange PAM deployed entirely within banking infrastructure, ensuring sensitive credentials never leave organizational boundaries.

AWS and Azure marketplace deployment provides rapid scalability, automated updates, and reduced infrastructure overhead while maintaining enterprise-grade security for financial institutions.

Seamlessly connects traditional core banking systems with cloud applications through unified PAM architecture, enabling phased modernization without disrupting critical operations.

Secure privileged access to transaction processing systems, customer databases, and account management platforms with role-based controls and comprehensive audit trails.

Ensure SWIFT CSP adherence with dual authorization, session recording, and secure access to messaging infrastructure and payment processing networks.

Protect distributed ATM networks and branch systems with centralized credential management and secure remote access for maintenance technicians.

Safeguard PCI-compliant environments such as credit card processing, merchant services, and digital payment gateways, with just-in-time access controls.

Manage privileged access to PII, credit histories, and financial records with role-based permissions for compliance teams and customer service representatives.

Generate comprehensive compliance documentation for SOX, GDPR, and NCUA examinations with automated audit reports and real-time compliance dashboards.

miniOrange's agentless PAM eliminates complex endpoint installations and maintenance requirements, deploying immediately across existing banking infrastructure without service interruptions.

Industry-tailored configurations streamline integration with core banking systems and legacy protocols through advanced, customizable connectors.

Our proven architecture scales seamlessly from community banks to multinational finance institutions, supporting mission-critical security operations.

Flexible licensing and deployment deliver full privileged access management without the high costs of traditional enterprise security vendors.

Privileged Identity Management (PIM) solution prevents unauthorized access and detects potential fraud attempts before they impact critical banking or finance transactions.

miniOrange PAM ensures only authorized personnel can access sensitive financial data and core banking systems while maintaining operational efficiency.

Remote workforce and vendor access create significant security risks for financial institutions, with PAM that provides secure, time-limited access.