Need Help? We are right here!

Search Results:

×Managing identity and access across the bank's widespread infrastructure presented multiple critical challenges, impacting security, compliance, and operational efficiency.

The bank's identity and access management faced significant challenges, primarily due to:

NBB needed a secure, scalable, and compliant solution to simplify user access across critical banking apps. After evaluating vendors, it chose miniOrange for its end-to-end SSO and Identity Governance capabilities. With seamless integration, strong security, and support for banking platforms, miniOrange streamlined authentication, reduced IT overhead, and secured access across 30+ applications.

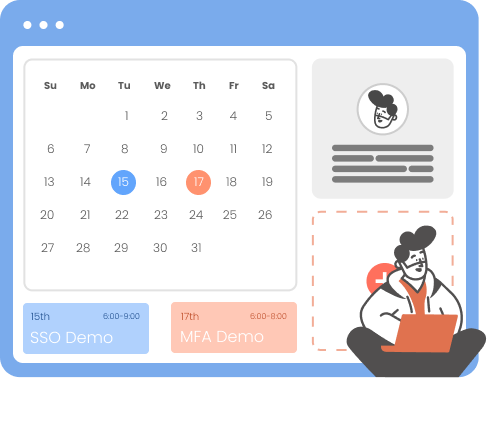

Before miniOrange, users had to remember multiple credentials, leading to password fatigue and login delays. With miniOrange’s Single Sign-On (SSO), users now access all their banking apps with a single set of credentials. Integration with Active Directory and the HR system ensures accurate, real-time identity sync. Support for protocols like SAML, OAuth, JWT, and even Kerberos Authentication means smoother logins across devices, especially for Windows users.

The bank needed to track every login attempt and detect suspicious behavior instantly. miniOrange is integrated with QRadar SIEM, enabling centralized logging and real-time alerts. This gave the security team immediate visibility into potential threats, adding another layer of defense.

From employees to guests, miniOrange helped implement role-based authentication policies for network access. Whether it’s a corporate device or a visitor laptop, users are only allowed access based on predefined permissions, securing the bank’s Wi-Fi from unauthorized usage.

miniOrange came ready with SSO connectors for more than 30 banking and enterprise applications like Amlock-SWX, Fircosoft, Intellimatch, Switchware, and more. This significantly reduced integration time and ensured fast, smooth onboarding.

To ensure zero downtime, the bank deployed two Identity Provider (IDP) instances behind a smart Load Balancer. The system intelligently splits traffic between IDP1 and IDP2. If one goes down, the other takes over, keeping services online without interruptions.

miniOrange designed a Master-Slave-Slave database setup to avoid data loss and ensure high availability. If the master database fails, a slave instantly takes over, so user access continues without hiccups—even during outages or maintenance windows.

To maintain stability and reduce risks, the bank uses UAT (User Acceptance Testing) to validate changes before pushing them to Production. This clear separation ensures every deployment is well-tested and stable in production before releasing. It helps to minimize downtime and ensures a seamless customer experience without any interruptions.

miniOrange’s Identity and Access Management (IAM) solution delivered a complete transformation of the bank’s access control system. With centralized Single Sign-On (SSO), the bank enabled seamless and secure access to critical applications, reducing credential fatigue and boosting employee productivity, without compromising security. Automation further streamlined IT operations, while legacy system compatibility ensured smooth integration across the bank’s digital ecosystem. The solution not only enhanced compliance with strict cybersecurity standards but also prepared the infrastructure for future scalability.

The National Bank of Bahrain (NBB), a leading financial institution in Bahrain, has significantly enhanced its security measures and streamlined operational processes by integrating miniOrange's Single Sign-On (SSO) and Identity Governance solutions. This strategic implementation has been crucial in securing and simplifying the authentication processes for over 1,000 employees across diverse banking applications.

By adopting these solutions, NBB not only ensures robust compliance with stringent banking security regulations but also improves the user experience, providing seamless access to essential systems. This initiative is part of NBB’s commitment to maintaining the highest standards of security and operational efficiency, positioning the bank as a forward-thinking leader in the financial industry.