Need Help? We are right here!

Search Results:

×99.9%

3-5

40%

Financial institutions face an increasingly intricate patchwork of regulations that vary by region, demanding sophisticated governance frameworks and technology solutions.

ATO attacks have grown in sophistication, with criminals leveraging stolen credentials, social engineering, and advanced phishing techniques to gain unauthorized access.

Inadequate data protection mechanisms, including insufficient encryption, poor access controls, and vulnerable data storage, can lead to breaches exposing sensitive customer information.

As financial services increasingly rely on APIs, which become prime targets. API vulnerabilities include inadequate authentication, broken authorization, & excessive data exposure.

Financial organizations typically operate numerous applications, maintaining separate identity stores. This fragmentation creates security gaps and delivers poor user experiences.

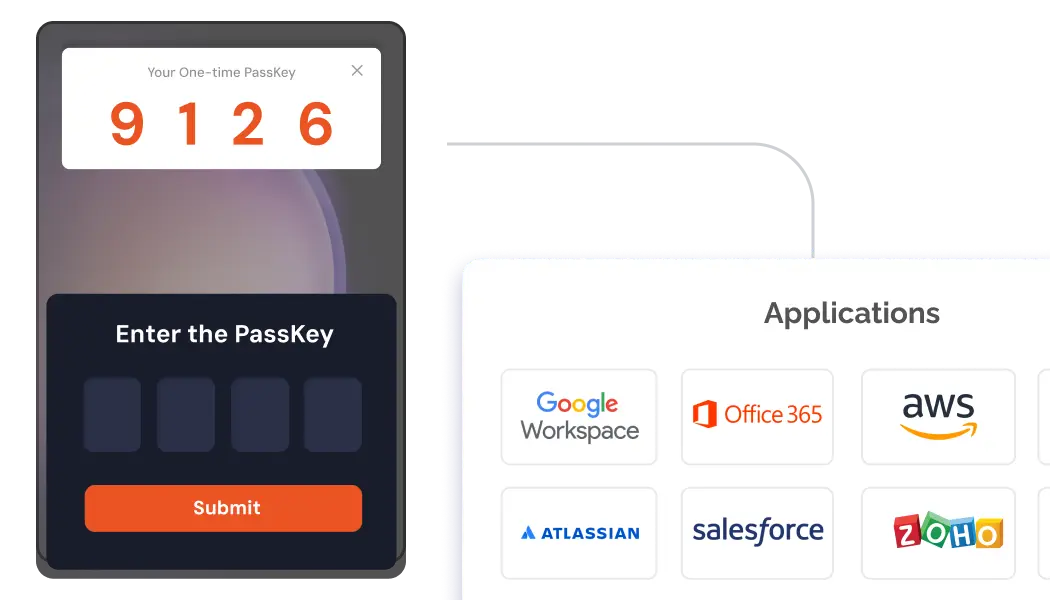

Securely deploy SSO with our library of 6,000+ pre-built integrations. Connect applications without the overhead of custom integration, ensuring both speed and security.

Read more

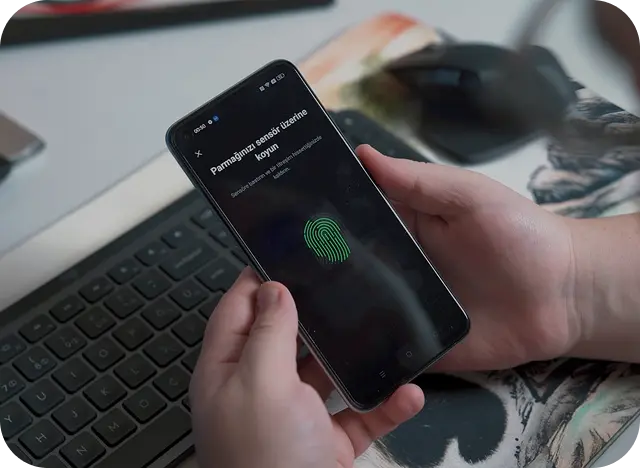

Choose from 15+ MFA Methods, such as OTP Over Phone/SMS, Authenticator apps, etc. Protect your network devices and Active Directory, Windows, Linux, and Mac login access.

Read more

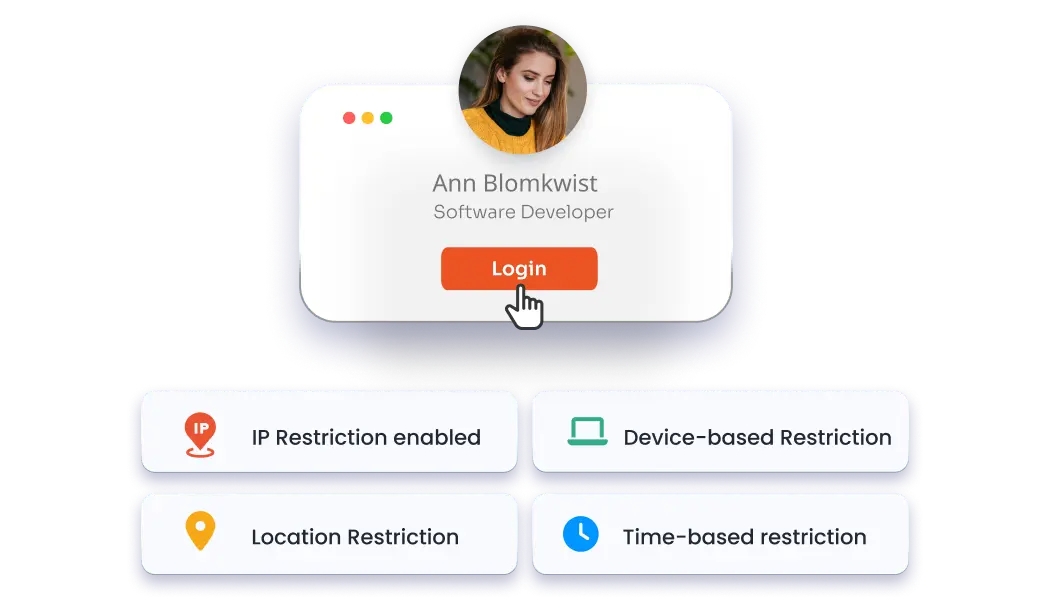

Set IP, Device, Location, and Time-Based Restrictions with miniOrange Adaptive MFA. It secures all your SaaS and Legacy applications and continuously assesses risk levels.

Read more

Transparently administer user-provisioning and de-provisioning operations with our user lifecycle management. Upgrade security and optimize performance in a cost-efficient manner.

Read more

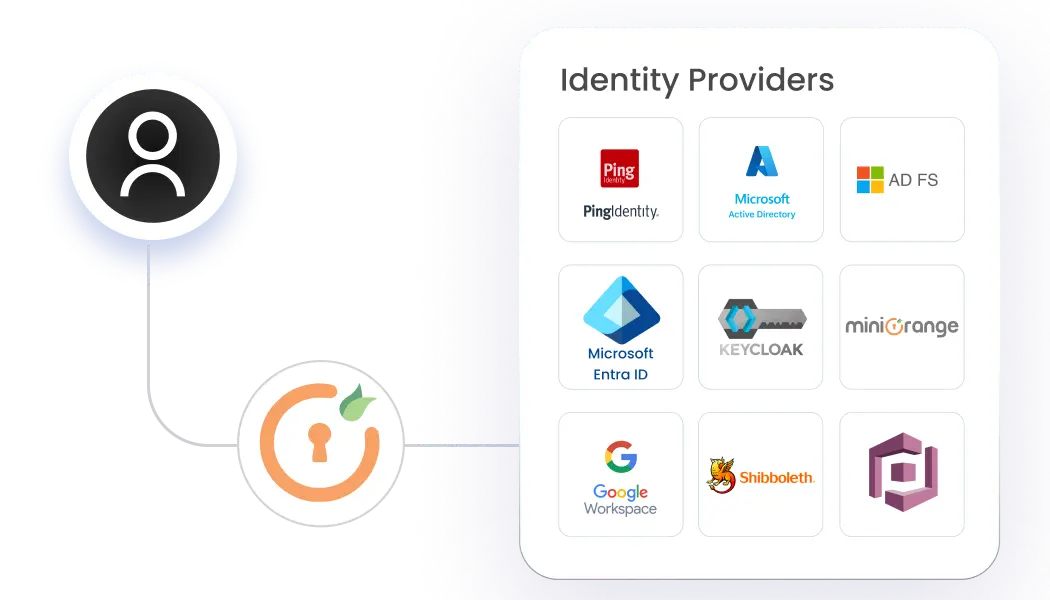

Configure multiple Identity Providers (IDPs) seamlessly and give users the option to select the IDP of their choice to authenticate with for brokering.

Read moreminiOrange offers personalizations designed for financial institutions. These include authentication flows, white-labeled branding, & API-driven architecture.

miniOrange detects different anomalous access patterns with sophisticated behavioral analytics before they become security incidents.

Our platform automates identity lifecycle from initial provisioning to eventual de-provisioning across all applications & systems.

miniOrange's architecture supports millions of identities while maintaining performance, ensuring our IAM grows with you.

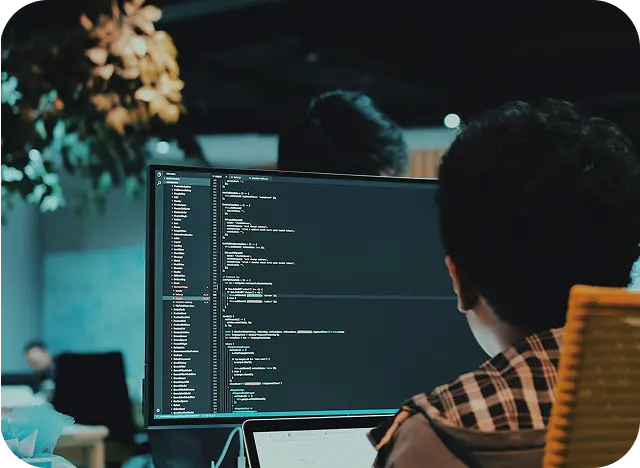

Deploy our IAM solution within your existing infrastructure seamlessly, integrating with legacy systems through standard protocols.

Secure identity management across AWS, Azure, Google Cloud, and specialized clouds, offering flexibility with robust security and compliance.

Achieve unified IAM security across your entire ecosystem, bridging legacy systems and modern clouds for a phased modernization.

miniOrange empowers financial institutions, including employees, partners, third-party vendors, and users, with our suite of IAM solutions. With miniOrange MFA, you can adhere to all mandates like NYDFS, FFIEC, GLBA, NIST, PCI DSS, and GDPR by providing essential security controls. We enable financial organizations to demonstrate compliance effectively, mitigate risks associated with non-compliance, and build trust with their stakeholders.

We also stand as a trusted access management software provider, delivering comprehensive device insight and adaptive access policies crucial for satisfying SOC 2 requirements and a wide spectrum of Financial Service Provider (FSP) mandates demanding robust access control. Our platform provides granular visibility into the devices accessing your environment, enabling the implementation of intelligent, context-aware access policies.