Need Help? We are right here!

Search Results:

×Decentralized Identity is a new way of managing your identity online instead of giving it to big companies or government databases to store. Businesses can benefit from this with stronger customer trust, faster onboarding, fewer data breach risks, and easier compliance with privacy laws like GDPR compliance and eIDAS. It’s secure, simple, and efficient.

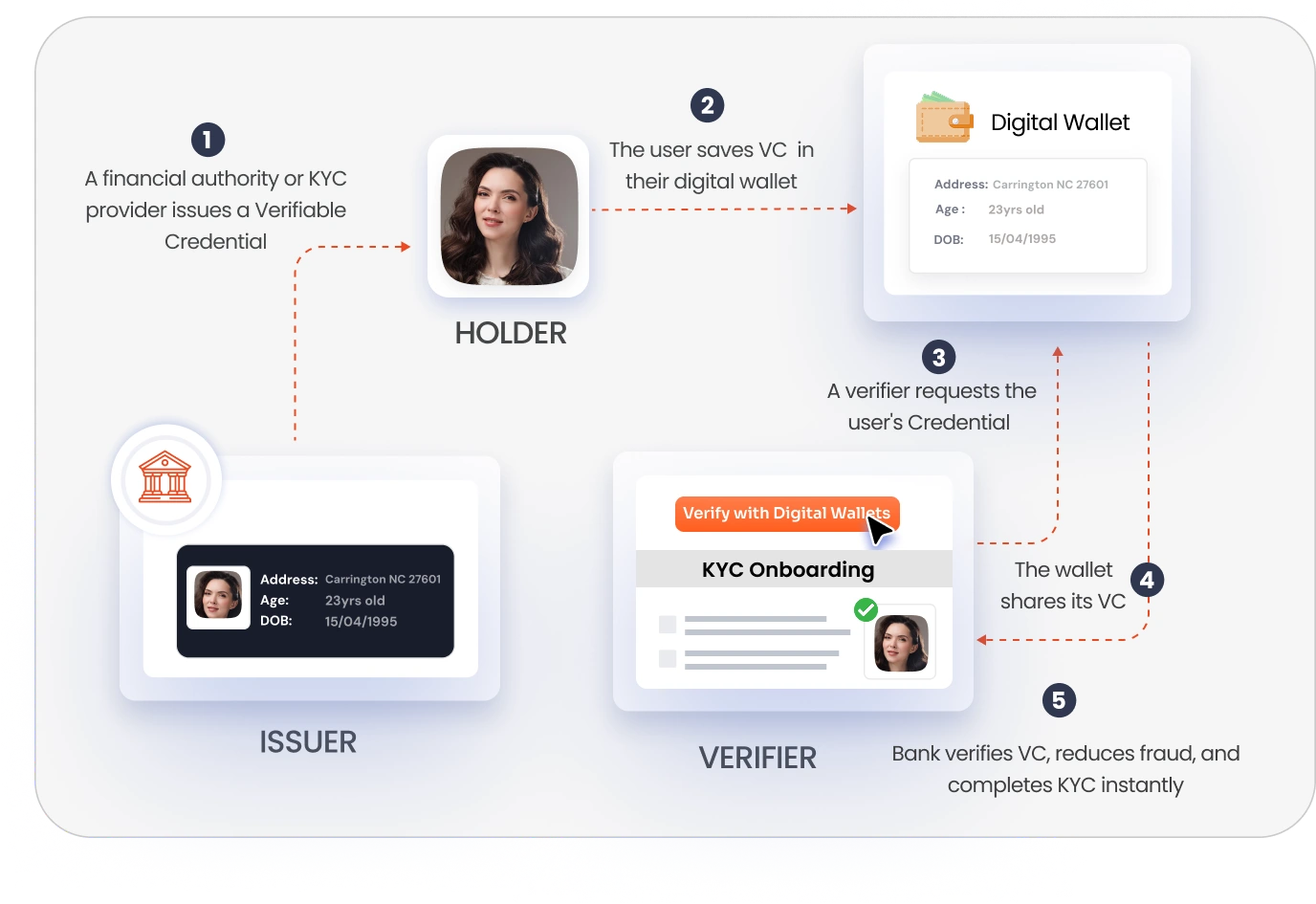

Decentralized Identity (DID) in banking gives people full control over their personal data. It makes KYC checks faster, improves privacy, boosts security by avoiding big data stores, and helps more people access financial services.

Accelerate customer onboarding and stay ahead of fraud with KYC Automation, smart eKYC, and verifiable credentials — built for faster, safer, and fully compliant banking experiences.

Unlock next-level trust with blockchain identity verification — secure, transparent, and tamper-proof solutions made to meet the toughest financial regulations.

Integrate a digital identity wallet across platforms to boost user experience and drive true financial inclusion without borders.

Take control with Role-Based Access Control — enforce least-privilege access, strengthen your security, and ensure regulatory compliance effortlessly.

Real-Time Compliance Audits deliver continuous monitoring & automated reporting, helping your institution meet regulatory compliance, such as PSD2, AML, GDPR compliance, and eIDAS 2.0 with total transparency.

Put users in control with Self-Sovereign Identity — a privacy-first approach that eliminates data silos, reduces identity fraud, and builds trust through user-owned digital identities.

A leading bank struggled with outdated onboarding systems, rising customer drop-off rates, and inefficient KYC workflows that couldn’t keep pace with digital transformation.

By adopting decentralized identity, the bank digitized KYC, enabled instant ID verification, and eliminated manual checks — leading to a seamless, secure, and user-friendly onboarding experience.

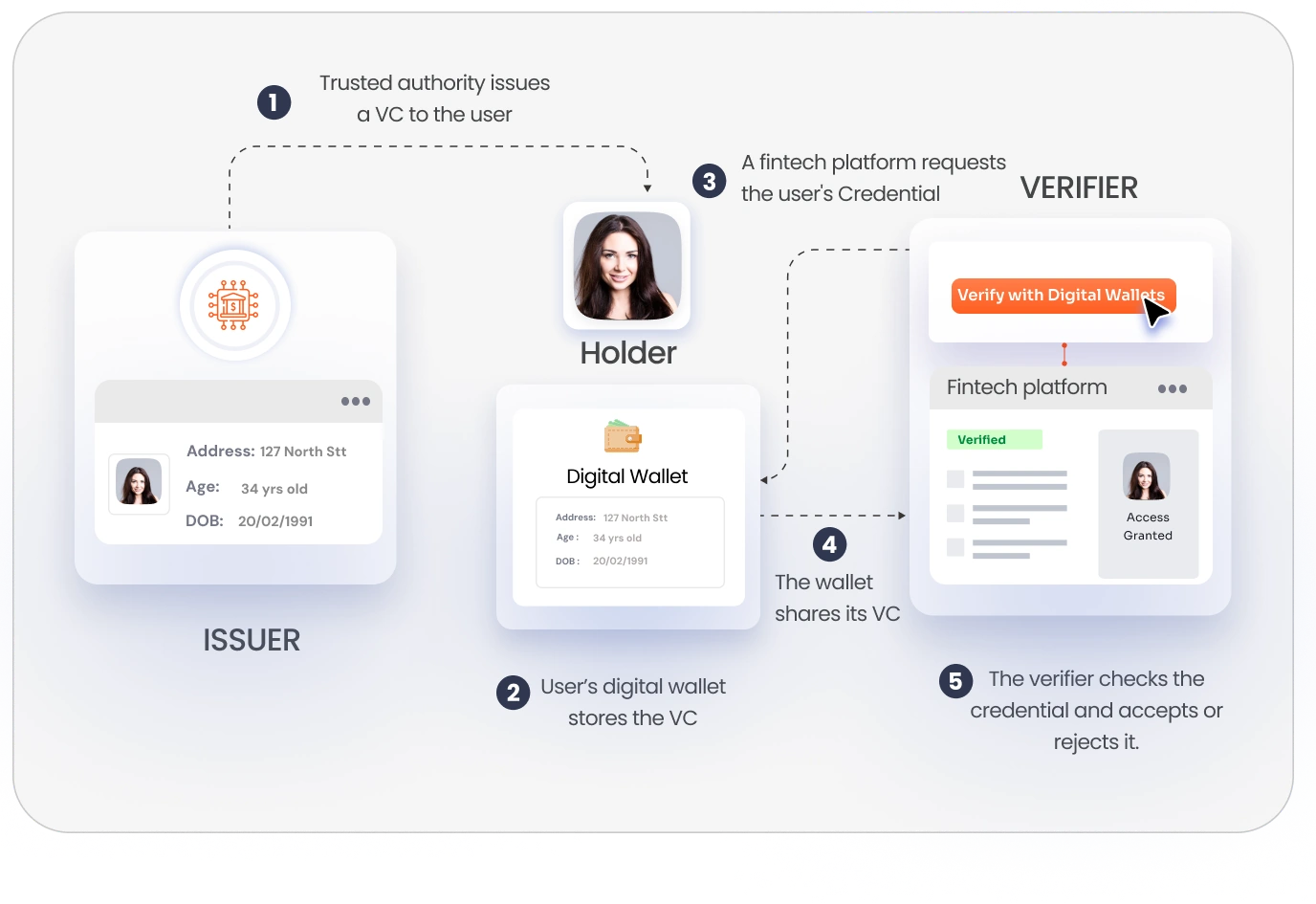

A fintech platform dealt with inconsistent user verification across regions, leading to friction in user experience, delayed approvals, and difficulty scaling securely in multiple markets.

With decentralized identity integration, the platform enabled global identity reuse, offering users secure, cross-border onboarding with user-controlled consent, eliminating repetitive verifications.

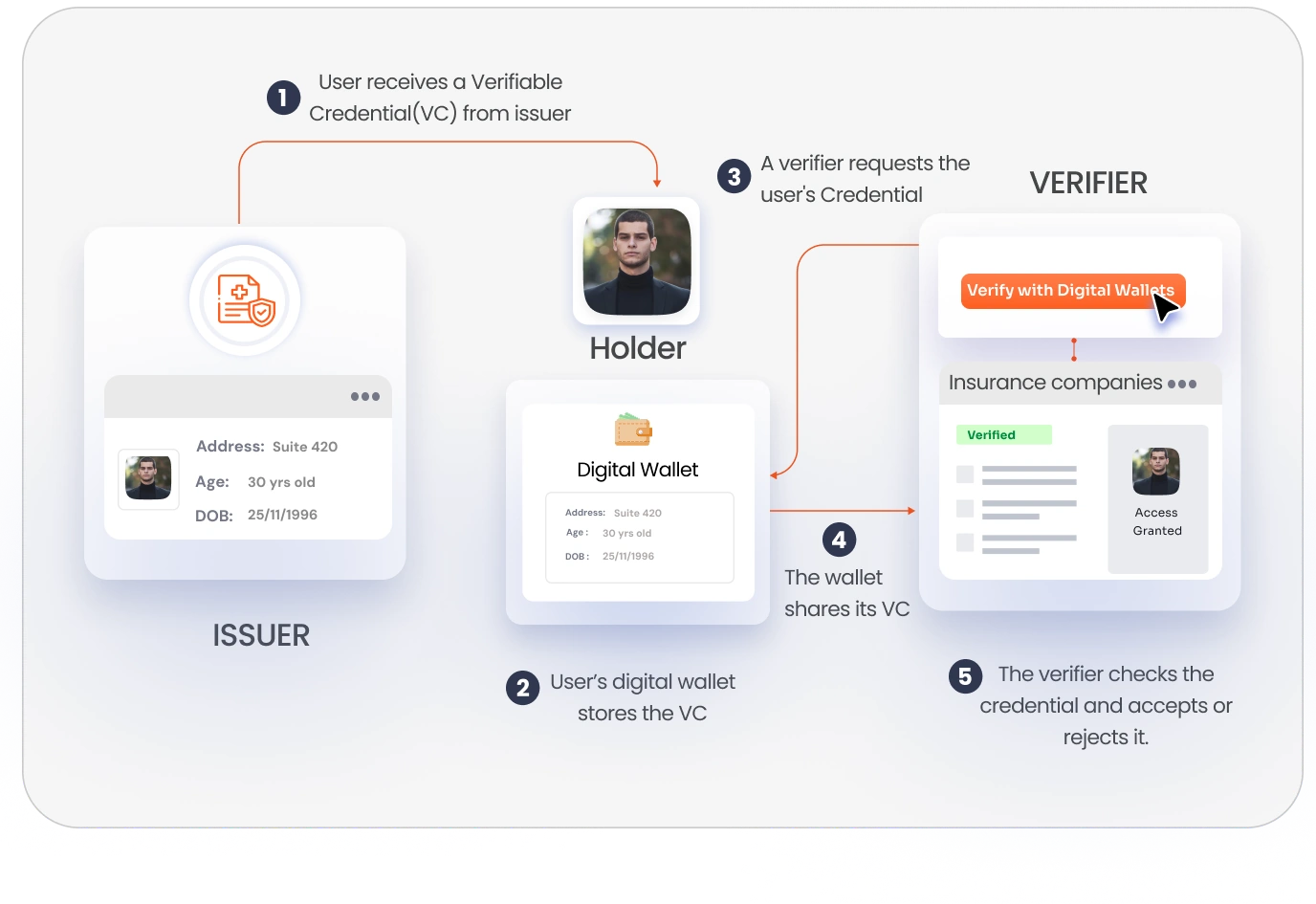

Insurance companies were impacted by false claims, identity fraud, and manual compliance reporting, slowing down processes and harming customer confidence.

With decentralized identity, insurers enabled automated, secure onboarding, digital proof of identity and coverage, and faster claim validations — all without centralized data exposure.

BNPL platforms faced rising fraud risks, including synthetic identities and account takeovers, leading to financial losses and consumer mistrust.

Implementing decentralized identifiers (DIDs) and verifiable credentials enables secure, privacy-preserving identity authentication, enhancing fraud prevention for banks and reducing fraud.

Thank you for your response. We will get back to you soon.

Please enter your enterprise email-id.