Need Help? We are right here!

Search Results:

×Swiss Digital Identity is a trusted digital identity provider solution—a modern, secure take on traditional Swiss identity cards. As a verified electronic ID in Switzerland, it enables fast and compliant digital identity verification using official government-issued documents. In short, Swiss eID is your gateway to reliable user authentication and advanced fraud protection for digital services.

Built to verify every Swiss ID card—and every regulation Swiss enterprises face.

Confidently operate in Switzerland with a platform built for its legal, digital, and operational standards—secure, precise, and compliant.

Secure identity verification in seconds using AI-based document checks and facial biometrics—minimizing fraud and manual review.

Accepts Swiss ID cards, residence permits (L, B, C), Swiss passports, and international documents. Whether your users are local citizens or foreign residents, our eID solution for enterprises verifies them with ease.

Comply with Swiss regulations—FINMA AML, GDPR-compliant eID, & local data residency requirements. Meet Switzerland’s strict legal standards with eID solution for enterprises.

Easily onboard users inside and outside Switzerland with secure identity verification solution—perfect for fintech, eCommerce, and SaaS businesses scaling globally.

Build trust, meet compliance standards, and prepare for decentralized identity ecosystems with with support for Self-Sovereign Identity and verifiable credentials.

Trust your Swiss eID system—certified, encrypted, and regulation-proof.

Fully aligned with Swiss anti-money laundering (AML) regulations—essential for financial institutions.

User data is encrypted at rest and in transit, with full audit trails for transparent, compliant data handling.

Our security framework meets globally recognized standards for information security management.

Third-party audited to ensure ongoing compliance with leading practices in data security and confidentiality.

Simple, secure, and fast Swiss identity verification—in four clicks or less.

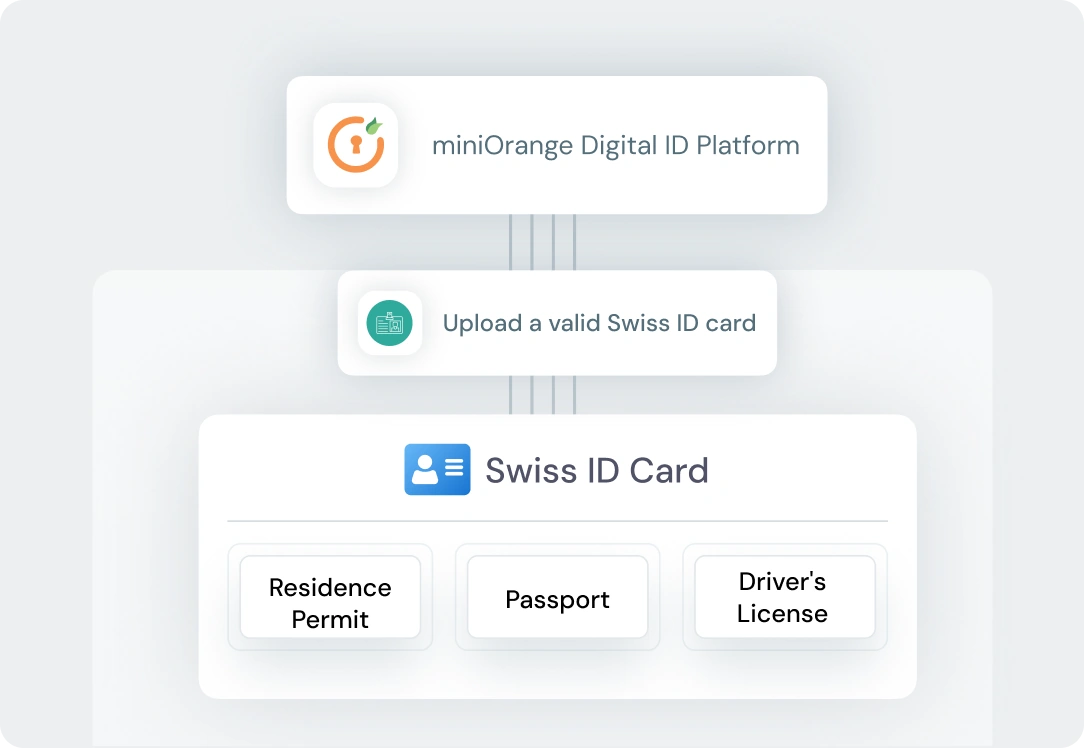

Start by uploading a valid Swiss ID card, residence permit, or passport through the miniOrange Digital ID platform. Our solution is fully compatible with SwissID standards.

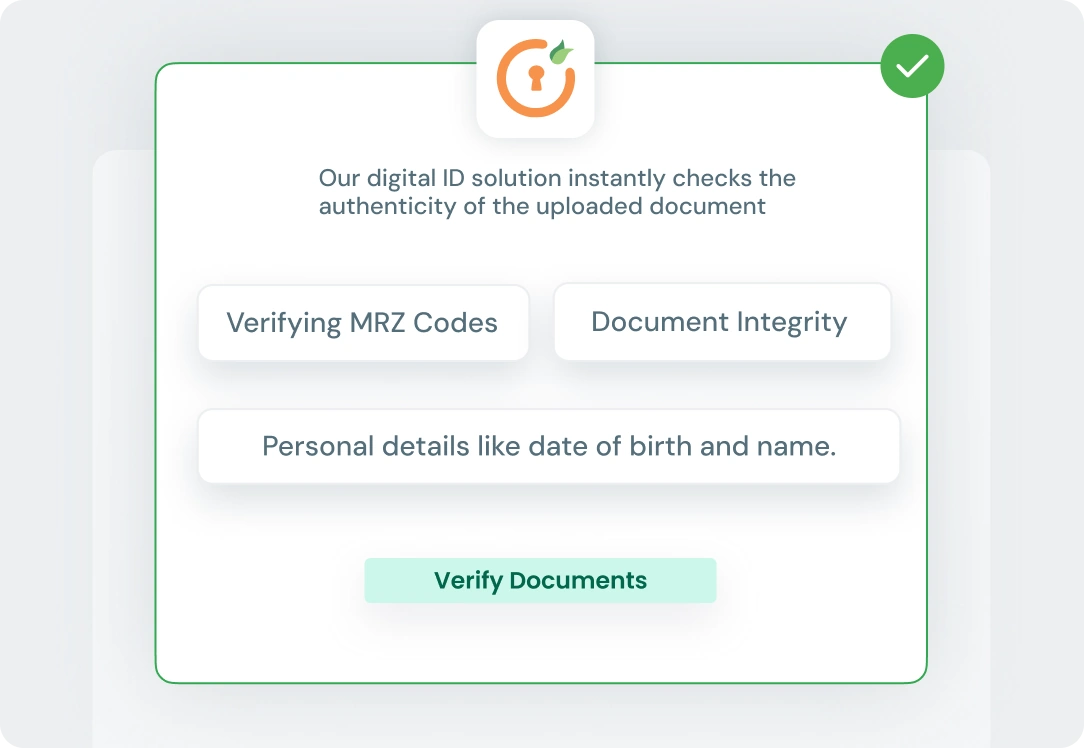

Our digital ID solution instantly checks the authenticity of the uploaded document, verifying MRZ codes, document integrity, and matching personal details like date of birth and name.

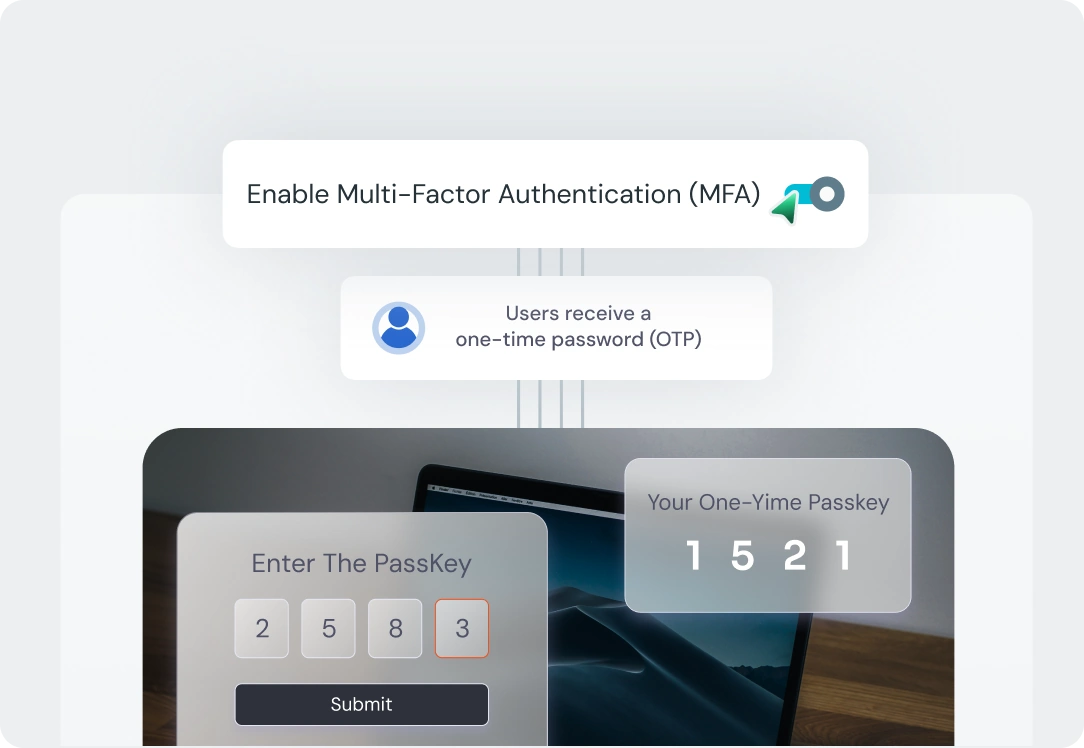

Add an extra layer of protection with MFA. Users receive a one-time password (OTP) via SMS, email, or an authenticator app.

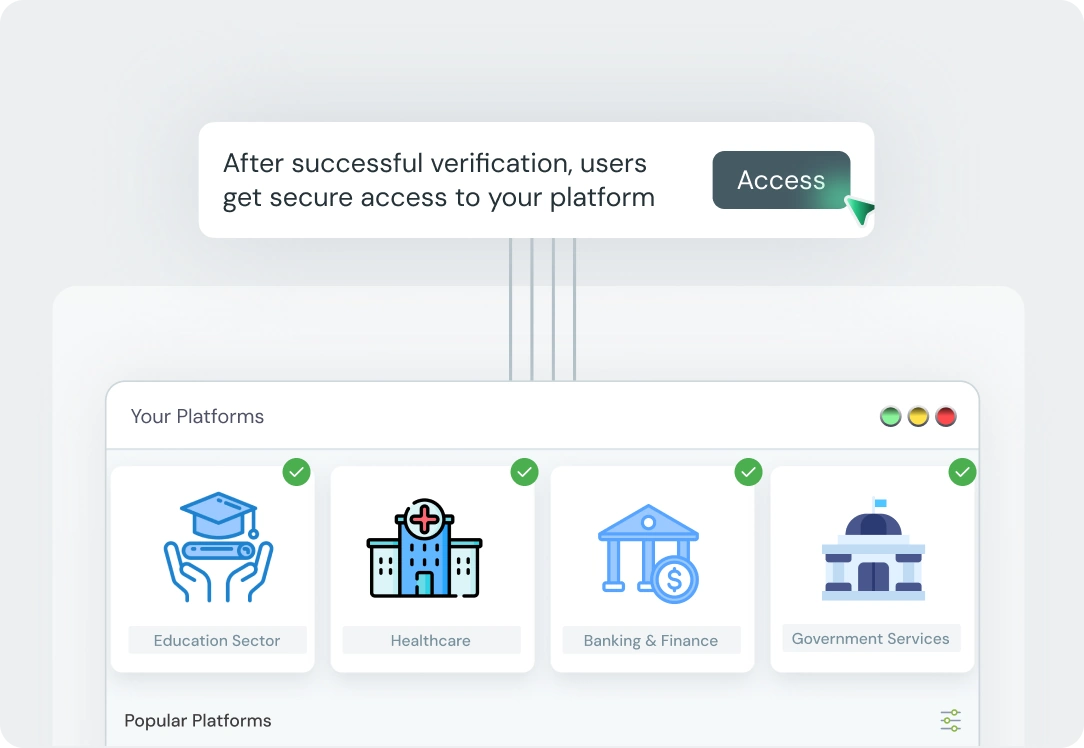

After successful verification, users get instant and secure access to your platform, whether they are Swiss nationals or hold valid foreign documents.

Wherever a Swiss identity card is used—we make it digital and secure.

Financial institutions like banks, crypto platforms, and fintech startups use Swiss eID to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. With Swiss eID verification solution, these businesses can verify both locals and expats holding a Switzerland ID card or passport.

From patient check-ins to health insurance claims, identity verification is critical. Swiss hospitals and telehealth platforms use our eID solution to verify identity via their Swiss ID card without visiting clinics, ensuring that sensitive health records are only accessible by the right people.

Swiss federal agencies are leveraging eID to digitize public services. From online tax filing to document renewal and e-voting, Citizens use their Swiss identity card or digital credentials from home. miniOrange ensures these transactions are encrypted and verified, promoting trust in e-Government.

Universities and e-learning platforms benefit from fast and secure student onboarding with Switzerland identity card. Whether it's verifying academic credentials, issuing diplomas, or managing student portals, miniOrange solution helps educational institutions save time and ensure accuracy across departments.

Hiring and onboarding processes can be time-consuming and error-prone. With Swiss eID integrated via miniOrange, HR teams can verify identity, authenticate documentation, and set up secure employee access within minutes. This boosts efficiency and reduces the risk of onboarding someone with fraudulent credentials.

We make it super simple to plug into your existing IAM and onboarding workflows Identity Wallet regulations.

Get full compliance with eIDAS 2.0, FINMA AML, GDPR, and EU Digital Identity Wallet regulations.

Our track record in delivering high-assurance Digital ID and Decentralized KYC solutions for industries worldwide.